Types of Plans

Selecting a health insurance plan is like searching for the right pair of jeans. It can be time-consuming and you may have to look at several, but it’s worth it to find the right fit. Some types of health insurance include government plans like Affordable Care Act (ACA) plans — which can also be called Marketplace or Exchange plans — Medicare plans and Medicaid plans. Before you choose a plan, it may help to review the various types of plans to get a better understanding of which type of health insurance may work best for you.

What are the different types of health insurance?

When’s the last time you thought about your health insurance? If you didn’t recently fill a prescription or need to see a doctor, it’s possible that the last time you thought about your insurance plan was last fall, during open enrollment. You can hit the ground running this year before open enrollment by understanding the different types of health insurance you can consider.

What is the Affordable Care Act?

The Affordable Care Act, or ACA (also referred to as “Obamacare”), was passed by the government in 2010 in an effort to make insurance more available and more affordable for everyone. ACA plans focus on preventive care and cover pre-existing conditions, in addition to a list of other health benefits. If you want ACA coverage, you must enroll during the established enrollment period. Typically, your coverage will take effect on the first day of the month after you enrolled.

What is Medicare?

Medicare is a federally funded and operated health insurance program originally designed for people who are 65 or older. Throughout the years, Medicare has expanded to include disabled people under 65 and those with special circumstances. The program is divided into four parts: A, B, C and D, and is the same nationwide.

What is Medicaid?

Medicaid is a federal and state program in place for low income families, seniors and individuals with mental or physical disabilities. People qualify for Medicaid by meeting federal income standards. The program is operated on a state-by-state basis, and may be called different names depending on where you live. In Minnesota, for example, Medicaid is called Minnesota Medical Assistance.

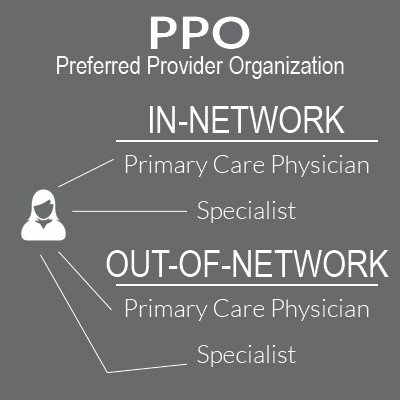

What are HMO, PPO, EPO and POS health insurance plans?

Which insurance is most affordable? Which health insurance plan is right for you? For a lot of people who get their health insurance through their employer, it comes down to what options are available. If there is more than one choice, you likely have to decide between an HMO, PPO, EPO or POS option. People shopping for Medicare plans may also be choosing between these same types of options. Not everyone has the same options, but it may help to understand more about how each of these plans work.

Point-of-Service (POS)

The Point-of-Service is like a combination of HMO and PPO. Like an HMO, you choose a doctor, also called a primary care provider (PCP). But like a PPO, you can get medical care from both in- or out-of-network providers. You’ll pay less when you use a doctor or hospital in network and more if you choose out of network.

High-Deductible Health Plans (HDHP)

This plan gives you the most control on how your healthcare dollars are spent. A High Deductible Health Plan usually has a high deductible but a low monthly premium and a special spending account to help you save money for healthcare expenses. These special accounts include health savings accounts (HSAs), health reimbursement account (HRAs) and flexible spending accounts (FSAs).

Metal categories

Health plans are broken into categories named after metals: Bronze, Silver and Gold. These categories reflect how you and your plan share the cost of your healthcare. The plan you select has nothing to do with the quality of care you receive — but rather how much you pay for healthcare services. A Bronze plan is ideal for people who don’t plan on using their insurance very often and a Gold plan is good for people who use the healthcare system more often.

Bronze

- Lowest monthly premium

- Highest costs when you need care

- Bronze plan deductibles — the amount of medical costs you pay before your insurance plan starts to pay — can be thousands of dollars a year

- Good choice if: You want a low-cost way to protect yourself from worst-case medical scenarios, like serious sickness or injury. Your monthly premium will be low, but you’ll have to pay for most routine care yourself.

Silver

- Moderate monthly premium

- Moderate costs when you need care

- Silver plan deductibles — the costs you pay before your plan pays anything — are usually lower than those of Bronze plans

- Good choice if: You qualify for “extra savings” — or, if not, if you’re willing to pay a slightly higher monthly premium than Bronze to have more of your routine care covered.

Important: If you qualify for “extra savings” (sometimes called “cost-sharing reductions”) on your deductible, copay, and coinsurance, it might be best for you to pick a Silver plan. You can save hundreds or even thousands of dollars per year if you use a lot of care.

Gold

- High monthly premium

- Low costs when you need care

- Gold plan deductibles — the amount of medical costs you pay before your plan pays — are usually low

- Good choice if: You’re willing to pay more each month to have more costs covered when you get medical treatment. If you use a lot of care, a Gold plan could be a good value.

What is COBRA?

COBRA stands for the Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA), a program that may help if you need coverage between jobs. If you lose your job, become furloughed or experience reduced hours and it changes your health insurance coverage, you may look into COBRA for health care coverage. With COBRA, you can continue the same coverage you had when you were employed. That includes medical, dental and vision plans.

What is short term health insurance?

Short term health insurance, also called temporary health insurance or term health insurance, may be right for you if you need to fill a gap in coverage until you can choose a longer-term solution. It might be a good option if you’re in between jobs, waiting for coverage to start, looking for coverage to bridge you to Medicare, turning 26 and coming off your parents’ insurance or many other situations. Short term health insurance offers flexible, fast coverage for those dynamic times of change in your life.